Content

All successful freelancers and businesses have stable finances and tight books. Find a bookkeeper or accountant that will update your books on a monthly basis — at a minimum. If you have a bunch of transactions, you may need weekly or bi-weekly reporting. By the time they pay Zillow, the real estate agent, and the brokerage, they lost money. They would have been better off keeping the money than trying to drive production volume up. Of course, this only holds true for real estate agents who are managing their books and keep some financial control.

- Any crossover between personal and business domains is where things get dicey.

- Bookkeeping for real estate is an important activity for investors who hope to keep their finances in order.

- When you start investing in your first rental properties, you will probably have questions about using one bank account or multiple for each property.

- Its $5.99 per month Home & Business plan offers features specific to real estate professionals.

- Instead of having to go to the bank daily to process payments, you can offer a list of accepted cards for added convenience and instant payment processing.

- If you have this kind of person on staff, then full steam ahead.

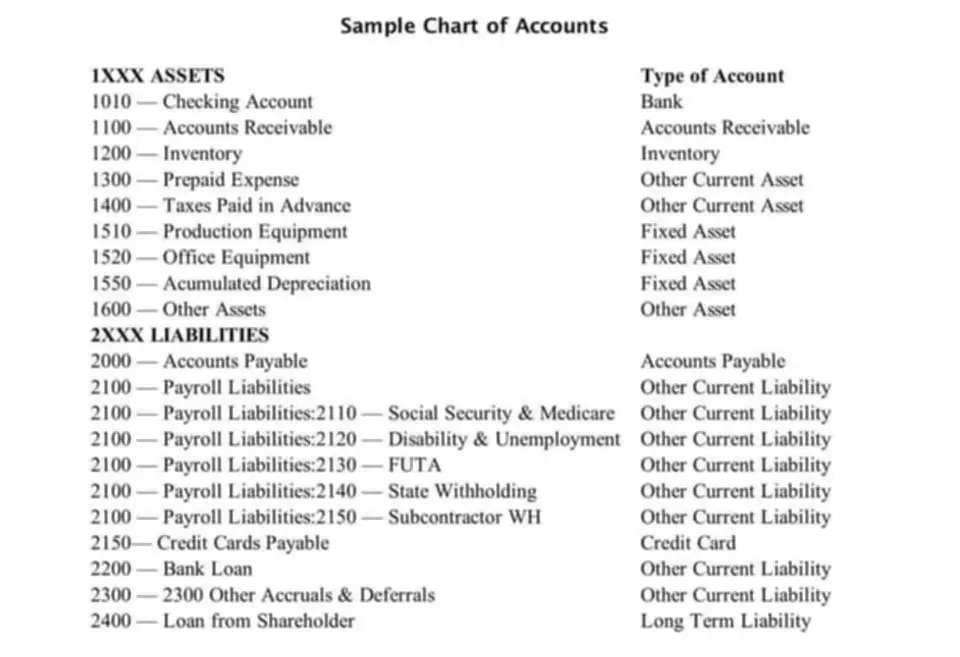

These agents help facilitate a financial transaction between property purchasers and sellers. Also, to work with them to negotiate the most favorable conditions for a sale or purchase. A chart https://www.bookstime.com/ of accounts for a real estate company represents all the accounts of your business gathered in one location. It gives you a birds-eye overview of every financial transaction of your company.

Overview of the Real Estate Industry

Don’t allow yourself to fly blind, switch to paperless accounting today. A good exercise to track your spending is to use a dedicated debit or credit card on all expenses for 30 days. If you use this for everything, from coffee to rehab materials, you will get a true idea of where your money is going every month. At the end of the 30 days, you should sit down and review what expenses were used to grow your business and which were essentially a waste of money.

- Under our assets listing, set up a category for each unit called improvements to record these transactions.

- Little things like looking at a cable bill or consolidating credit card debts can greatly reduce your monthly payment.

- You can also create your own categories and codes—and apply them automatically to your entries.

- At ShoreAgents, we offer full-time bookkeepers at varying costs and it all depends on the level you will need.

- Accounting is more subjective, providing business owners with financial insights based on information gleaned from their bookkeeping data.

Real estate professionals looking for a hands-off basic bookkeeping and tax service should consider hiring Bench. Why stress over trying to mitigate all the easy real estate bookkeeping ways to lose out on savings when an accountant can do that for you? The cost of services often can’t compete with the hours spent, and savings missed otherwise.

Reconcile Your Accounts

The main difference between the two methods is when income and expenses are “realized”. For example, the desktop version allows me to keep track of, record, and accurately report on my commission income, my flipping income, residual income, and affiliate income. If you wanted the same mileage tracking feature with Xero, you would have to sign up for their highest tiered plan, the Established Plan. You need to understand how to fund cash flow differences if you’re profitable but cash flow negative.

Keep every receipt and designate which property the receipt was for. You can even write the property and the purpose on the receipt. This is not only helpful for deducting the right amount at tax time—and proving to the IRS that you are legit—but it will keep you financially organized. The general rule for real estate is a company of ten people or more needs a full-time bookkeeper. Less than that, and you can get away with only using digital products. Realtyzam is available for Android and iOS and both desktop and mobile-based devices.

Sample Real Estate Agent’s Chart of Accounts

Accounting is analyzing, recording, and reporting financial information for a business. This includes the creation of budgets, studying financial trends, and evaluating strategies for increasing profits or reducing expenses. If you set aside a few minutes each day (or an hour or 2 weekly) to evaluate your charges and business expenses, you can keep your accounts clearly organized.

One good solution is to find an accountant first and go with the software package they are familiar with. Starting from the beginning, an accountant can help you develop a business plan. These could be cash held in the business, receivables due from tenants or buildings generating business revenue. Today’s leading accounting platforms offer standard security features such as data encryption, secure credential tokenization and more.

What is Real Estate Bookkeeping?

Large real estate agencies, for example, need different features and capabilities than solopreneur agents. With plans starting at $52, Buildium offers lots of features for managing rental properties’ finances and tenant journeys. Any crossover between personal and business domains is where things get dicey. Utilizing outsourced bookkeeping services like Less Accounting can streamline your accounts into defined paths. This will ensure you get an accurate snapshot of your business’ growth.

Komentar